Analyzing Operational Due Diligence Frameworks In Fund Of Hedge Funds

Abstract

An analysis was conducted using a sample of over 275 global hedge fund allocators of the operational due diligence frameworks in place at these organizations. By developing an understanding of the operational due diligence structures in place, this paper establishes a transparent benchmark against which operational due diligence frameworks may be compared. The findings indicate there is a substantial variety present in the operational due diligence frameworks utilized by hedge fund allocators, such as fund of hedge funds. On a global basis, a myriad of hybrid approaches are in place at smaller allocators. Regionally, while a dedicated approach to operational due diligence is generally favored, no one framework emerged as a clear global leader. As compared to smaller allocators, larger organizations seemed to have more resources dedicated specifically to operational due diligence. These findings are consistent with predictions that hedge fund allocators such as fund of hedge funds, in part driven by investor demand, will continue to allocate more resources to underlying hedge fund manager operational due diligence.

Due diligence is a critical component in the hedge fund selection and allocation process. In light of a series of recent losses due to fraudulent activities and Ponzi schemes by individuals such as Bernard Madoff, both hedge fund allocation organizations such as fund of hedge funds as well as investment consultants who recommend hedge funds to investors will likely need to rethink their approaches towards due diligence. In its current state, the modern hedge fund due diligence paradigm can be broadly bifurcated into two main sub-sections of due diligence: investment and operational. For the purposes of this study, the term operational due diligence is utilized to refer to the process of gathering data regarding a hedge fund’s operational risks (i.e. non-investment related risks). Examples of the operational risk factors on which data is typically gathered during an operational due diligence review include compliance processes, valuation techniques, information technology infrastructure, business continuity and disaster recovery planning, cash management controls and quality of third-party service providers such as administrators and auditors.

Throughout the fund of hedge funds universe, the operational due diligence process suffers from a global lack of uniformity in establishing a minimum floor for the amount of operational data which should be collected. Furthermore, there is no consensus on which operational risk factors should be analyzed at a minimum, as part of the operational due diligence process. As such, there is a wide variety in both the robustness of operational due diligence processes and frameworks in place across the fund of hedge funds universe. To date, fund of hedge funds have taken a myriad of approaches towards:

- Determining the amount of resources to dedicate to operational due diligence

- Designing the structure of their operational due diligence functions

- Determining when operational due diligence becomes involved in the entire due diligence process

This paper examines the second element cited above, namely the current structure of operational due diligence frameworks currently employed by fund of hedge funds, with a goal towards establishing a transparent benchmark of global and regional trends in operational due diligence framework utilization.

Organizations Which Were Included in This Study

For the purposes of this study, the term fund of hedge funds was defined as an investment organization whose primary purpose is to allocate capital to a portfolio of underlying hedge fund managers. The types of institutions from which data was obtained included those organizations which market themselves as fund of hedge funds as well as multi-family offices, large independent financial advisory practices and private banking organizations that manage portfolios of hedge funds on behalf of their clients.

Certain fund of hedge funds organizations included in this study were part of larger organizational entities which managed several products in addition to fund of hedge funds. In these specific cases, only the fund of hedge funds units that were separately managed entities with distinct management, despite any affiliations (legal or otherwise) with related parties, were included in this study. The hedge fund managers allocated to by the fund of hedge funds could be of any investment strategy. Additionally, while some of the managers included in this study maintained separately managed accounts with underlying hedge fund managers, the vast majority did not, and their investments were in pooled vehicles managed by the hedge fund manager.

Fund of hedge funds that primarily allocated to funds that were not hedge funds (i.e. - private equity funds, venture capital funds, real estate funds etc.) were not included in this study. Organizations which solely manage their own proprietary capital, such as certain pensions, endowments, charitable philanthropies and single family offices were excluded from this study. No restrictions were placed on the length of time on which the organization had been in business to be included in this study. That being said, the shortest life span of the organizational age of a fund of hedge funds included in this study was approximately nine months.

A globally diverse cross-section of fund of hedge funds were included in this study as there were no geographic restrictions. All fund of hedge funds organizations were broadly classified into one of three geographic regions: Asia, Europe and North America. It should be noted that the regional classification were utilized to reference the location of fund of hedge funds organizational headquarters and not any directional geographic biases which may have been present in the portfolios of underlying hedge funds to which they may allocate.

Number of fund of hedge funds included in this study

In order to respect the confidentiality of both those organizations that directly participated in this study or upon which research had been performed, the names of specific organizations have intentionally not been disclosed. Furthermore, the exact number of fund of hedge funds managers utilized in this survey is not specifically disclosed. This is to prevent reverse engineering of the specific identity of any one fund of hedge funds organization included in this survey. A range of the number of fund of hedge funds reviewed has been provided. In this study between 275 and 350 fund of hedge funds were utilized.

Data

Sources:Data from this study was culled from a variety of different sources. The primary sources utilized included interviews and surveys with employees working at funds of of hedge funds organizations as well as other organizations, as described above, which allocate to hedge funds. Other data was collected from publically available databases and regulatory archives including those maintained by the United States Securities and Exchange Commission, the United Kingdom based Financial Services Authority, the Hong Kong Securities and Futures Commission and the Cayman Islands Monetary Authority. As a general comment, all percentages stated in this report have been rounded to the nearest whole percent.

Geographic distribution:

Of those fund of hedge funds managers included in this study, as summarized in Table 1, 74% were from North America, 20% from Europe and 6% from Asia. For those fund of hedge funds which maintained multiple offices in different continents, the headquarters of the fund of hedge funds operations was generally utilized to determine geographic location.

Table 1: Percentage of Fund of Hedge Funds Included in This Study Classified by Region

| Region | Percent |

| North America | 74% |

| Europe | 20% |

| Asia | 6% |

Assets Under Management

There were no minimum assets under management (“AUM”) requirements for funds of hedge funds to be included in this study. For purposes of this study, fund of hedge funds were classified into two distinct groups with the separation point being USD $1 billion. Of those fund of hedge funds managers included in this study, 39% managed less than USD $1 billion and 61% managed more than USD $1 billion. All AUM figures were current as of December 31, 2008. The USD $1 billion cutoff represents total firm AUM and not just the amount invested in hedge funds however, for the vast majority of organizations under consideration hedge fund investments made up the bulk, if not all, of the firm’s assets. It should also be noted, that in most cases AUM figures were self-reported by the respective fund of hedge funds and were not independently verified as part of the course of this study.

Operational Due Diligence Framework Style Buckets

Fund of hedge funds operational due diligence frameworks were classified into four style buckets: dedicated, shared, modular and hybrid. It should be noted that each of these operational due diligence style buckets refer to the framework implemented at a fund of hedge funds to perform operational due diligence reviews. These style buckets do not address which individuals or groups at a fund of hedge funds holds the authority to make the ultimate operational conclusion regarding a particular hedge fund manager. Furthermore, these style buckets do not address which individuals or groups, such as an investment committee, has the final authority to make the final allocation decision to a hedge fund manager. A definition of each of the style categories follows below:

Dedicated - An operational due diligence framework where a fund of hedge funds has at least one employee whose full time responsibility is vetting the operational risks at hedge fund managers

Shared - An operational due diligence framework where the responsibility for reviewing the operational risk exposures at hedge funds is shared by the same individuals who have responsibility for investment due diligence. No full time dedicated operational due diligence staff are employed.

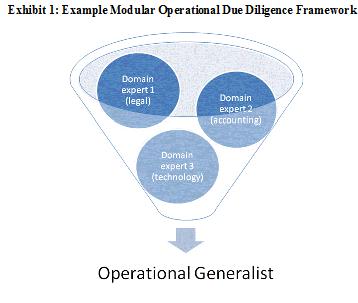

Modular - An operational due diligence framework whereby the operational due diligence process is classified into functional components and parsed out among different specialists with relevant domain specific knowledge. It is important to note that in a modular operational due diligence framework, these domain experts typically have other responsibilities within the larger fund of hedge funds organization outside of their operational due diligence responsibilities. Examples of the titles which these functional domain experts typically hold within the fund of hedge funds organization would be General Counsel, Chief Technology Officer, Chief Compliance Officer and Chief Financial Officer.

Under a modular approach the work of these domain experts is often pieced together by an individual or group of individuals which we will refer to as an operational generalist. The operational generalist can be thought of as an information aggregator who pieces together the disparate functional reviews completed by the domain experts to facilitate the fund of hedge funds organization progressing towards arriving at an operational risk conclusion. The operational due diligence duties of the operational generalist can be very similar to those of operational due diligence analysts under a dedicated framework and can include such things as on-site manager visits and operational risk report generation.

Under a modular framework the operational generalist or group of individuals performing the operational generalist function can either be a dedicated operational due diligence professional (i.e. - fitting into the definition of the dedicated approach) or the operational generalist(s) themselves can serve other functions within the organization and may even be domain expert(s) in their own right. An example of this would be an individual whose title is Chief Operating Officer and who has other responsibilities within the fund of hedge funds organization, yet who also serves as the operational generalist piecing together the operational due diligence work of the functional domain experts. Exhibit 1 summarizes the role of the operational generalist in a typical modular framework.

Hybrid - A hybrid operational due diligence framework refers to an approach that encompasses some combination of the three previously described approaches (dedicated, shared, modular). An example of a hybrid framework would be a fund of hedge funds organization that employs a full time operational due diligence analyst (i.e. - dedicated framework) while leveraging off in-house domain experts as needed. Continuing this example, these domain experts would not be a part of the standard operational due diligence review process followed by the fund of hedge funds (i.e. - such as a modular approach) but utilized on an ad-hoc basis. Another example of an operational due diligence framework which would be fall under the hybrid classification would be a fund of hedge funds which outsources the operational due diligence function, either in part or entirely, to a third-party operational risk consultant. Therefore, within those managers which fell into the hybrid classification it is important to note that a significant diversity of sub-approaches existed.

EMPIRICAL RESULTS

General Trends:

The global results of this study, summarized in Table 2, indicate a relatively equal distribution among three of the hedge fund operational due diligence frameworks (27% dedicated, 31% shared, and 28% hybrid) with the modular approach representing only approximately 14% of the operational due diligence frameworks of the fund of hedge funds managers included in this study.

Table 2: Operational Due Diligence Frameworks at Fund of Hedge Funds Globally

| Operational Due Diligence Framework | Percent |

| Dedicated | 27% |

| Shared | 31% |

| Modular | 14% |

| Hybrid | 28% |

Regional Analysis

Within each of the three regions covered by this study (Asia, Europe and North America) slightly different trends emerge as compared to the global data set. Specifically, Asian based fund of hedge funds were shown to slightly favor a dedicated approach (34%) over the roughly equal distribution of between the shared framework (27%) and hybrid approach (25%). The use of the modular approach in those Asian fund of hedge funds surveyed was 14% which mirrored the global trend.

In Europe, managers showed even a greater preference than in Asia towards a dedicated operational due diligence framework at 45%. Also dominating the European landscape were hybrid approaches at 32%. While 14% followed shared approaches, the modular approach was once again the least utilized approach at just 9%.

North American fund of hedge funds closely mirrored the global trends. This is unsurprising since North American based managers made up the vast majority of those fund of hedge funds included in this study. The operational due diligence framework data organized by region is presented in Table 3.

Table 3: Operational Due Diligence Frameworks Utilized by Region

| Region | Dedicated | Shared | Modular | Hybrid |

| Asia | 34% | 27% | 14% | 25% |

| Europe | 45% | 14% | 9% | 32% |

| North America | 22% | 34% | 15% | 29% |

Analysis by Assets Under Management

In examining the operational frameworks utilized when analyzing the fund of hedge funds as classified by AUM, marked differences are notable when comparing managers above and below the USD $1 billion level. Almost half of those fund of hedge funds managers under the USD $1 billion, 46% to be exact, utilize a hybrid operational due diligence framework. The next largest operational due diligence framework utilized at the under USD $1 billion level was the shared approach at 29%. Dedicated frameworks only made up approximately 14% of the fund of hedge funds included in this study. Once again, the least employed approach was a modular one at 11%.

For organizations with aggregate AUM larger than USD $1 billion the most employed operational due diligence framework was the dedicated framework at 32%. This was closely followed by shared operational due diligence frameworks at 30%. In fund of hedge funds organizaitons which managed over USD $1 billion the hybrid approach represented a much smaller 23% as compared to previous 46% in managers under USD $1 billion. Finally, continuing the trend, the modular approach was the least employed at 15%. Table 4 summarizes the results of analysis by AUM.

Table 4: Operational Due Diligence Frameworks Classified by AUM

| Operational Due Diligence Framework | AUM Under USD $1BN | AUM Over USD $1BN |

| Dedicated | 14% | 32% |

| Shared | 29% | 30% |

| Modular | 11% | 15% |

| Hybrid | 46% | 23% |

Conclusion

A considerable variety exists in the distribution of operational due diligence frameworks among fund of hedge fund organizations. While slightly more uniformity seems to be present on a regional basis and among managers with AUM under USD $1 billion, a diversity of approaches is still persistent in both large and small organizations. Explanations for these differences are attributable to a wide variety factors including the organic growth of the operational due diligence functions across divergent paths in different organizations over time, a previous lack of demand for dedicated operational due diligence functions and historical biases against rigorous operational due diligence reviews of underlying hedge fund managers which in turn would have required less dedicated resources.

In the post-Madoff environment it is likely that more investors will demand that fund of hedge funds perform increasingly rigorous and frequent operational due diligence reviews. When evaluating the operational due diligence function present at a fund of hedge funds, investors should consider the appropriateness of the operational due diligence framework in place as compared to the framework benchmarks outlined in this study. In order to both accommodate these investor demands and differentiate themselves from their competitors, fund of hedge funds will likely embrace a trend towards dedicating more resources to operational due diligence. As the nature of operational reviews continues to increase in both frequency and complexity it is likely that the hybrid framework will begin to increase in utilization. This shift will likely support a trend of fund of hedge funds organizations utilizing a combination of internal resources and third-party consultants to increase both the cost effectiveness and comprehensiveness of operational due diligence reviews.

For More Information

Analyzing Operational Due Diligence Frameworks In Fund Of Hedge Funds

Corgentum Consulting (173K PDF)